Malawi’s debt has surged to a staggering K13.1 trillion as of December 2023, up from K9.3 trillion the previous year, pushing the debt-to-GDP ratio to a concerning 85% of the country’s GDP.

The Ministry of Finance and Economic Planning has attributed the worsening debt levels to the devaluation of the kwacha and the conversion of short-term domestic borrowing (Treasury Bills) to long-term facilities (Treasury Notes).

Experts warn that the country’s debt situation is unsustainable, with possible continued high levels of borrowing on the horizon as the economy struggles to generate sufficient revenue to meet the Treasury’s needs.

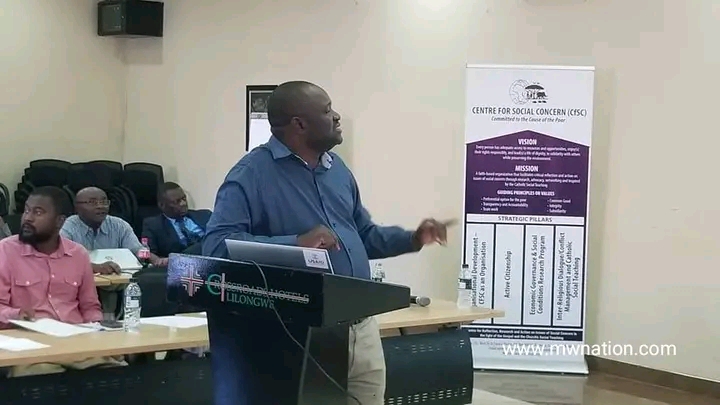

According to a report by the Centre for Social Concern (CfSC), Malawi’s public debt sustainability is under threat due to rising debt pressure and a lack of economic growth to support revenue needs.

The report, presented by CfSC consultant Lesley Mkandawire, warns that the country’s debt situation will continue to deteriorate unless drastic measures are taken to address the issue.

Economic experts are urging the government to take immediate action to address the debt crisis, including implementing austerity measures and seeking alternative sources of revenue to reduce the country’s reliance on borrowing.

With a debt-to-GDP ratio of 85%, Malawi is fast approaching a debt crisis, and urgent action is needed to prevent a catastrophic economic meltdown.